E-Commerce Success: Why an LLC is Essential for Amazon Sellers

The e-commerce industry is booming, with platforms like Amazon opening doors for entrepreneurs to reach global markets. While the opportunity to run an Amazon store is exciting, establishing a strong legal and financial foundation is key to long-term success. At Micahguruu Foundation, we specialize in helping Amazon sellers and e-commerce entrepreneurs start their journey with the right business structure—specifically, forming an LLC (Limited Liability Company).

In this blog, we’ll explore the importance of forming an LLC for your Amazon business and how it can help you build a professional and secure e-commerce brand.

Why Start an Amazon Store?

Amazon offers a powerful platform for entrepreneurs, allowing you to:

- Access a Global Market: Sell to millions of customers worldwide.

- Leverage Amazon’s Logistics: Fulfillment by Amazon (FBA) simplifies storage, shipping, and customer service.

- Earn Passive Income: Build a steady stream of income with minimal overhead costs.

However, with great opportunity comes responsibility, and protecting your business with an LLC can make a significant difference.

Why an LLC is Crucial for Amazon Sellers

-

Personal Liability Protection

An LLC separates your personal assets from your business. If your Amazon business faces lawsuits or debts, your personal finances (home, car, savings) remain protected. -

Tax Benefits

LLCs offer tax flexibility, allowing you to:- Benefit from pass-through taxation, avoiding double taxation.

- Deduct business expenses like inventory, advertising, and shipping.

-

Professionalism and Credibility

Operating as an LLC enhances your brand’s credibility with customers, suppliers, and partners. It demonstrates professionalism, which is essential in competitive marketplaces like Amazon. -

Easier Banking and Financial Management

An LLC allows you to open a dedicated business bank account, keeping your personal and business finances separate. This simplifies tax reporting and financial management. -

Scaling Your Business

As your Amazon store grows, having an LLC makes it easier to bring on partners, hire employees, or secure funding.

Steps to Launching Your Amazon Business with an LLC

-

Form Your LLC

Work with Micahguruu Foundation to set up your LLC quickly and accurately. We handle everything from state filings to EIN applications, so you can focus on your business. -

Register Your Amazon Seller Account

- Choose between an Individual Seller Account (for beginners) or a Professional Seller Account (for high-volume sellers).

- Use your LLC’s details, including your EIN, for registration.

-

Open a Business Bank Account

- Keep your finances organized by opening a business bank account under your LLC.

- Link this account to your Amazon seller account for smooth transactions.

-

Source Your Products

- Research profitable niches and reliable suppliers.

- Use Amazon tools like Jungle Scout or Helium 10 to analyze market trends.

-

Optimize Your Listings

- Create compelling product descriptions, use high-quality images, and focus on keywords for search engine optimization (SEO).

-

Market Your Store

- Leverage Amazon Ads, social media, and email marketing to drive traffic to your listings.

-

Comply with Tax and Legal Requirements

- Stay on top of sales tax collection and reporting.

- File annual reports and meet compliance requirements for your LLC.

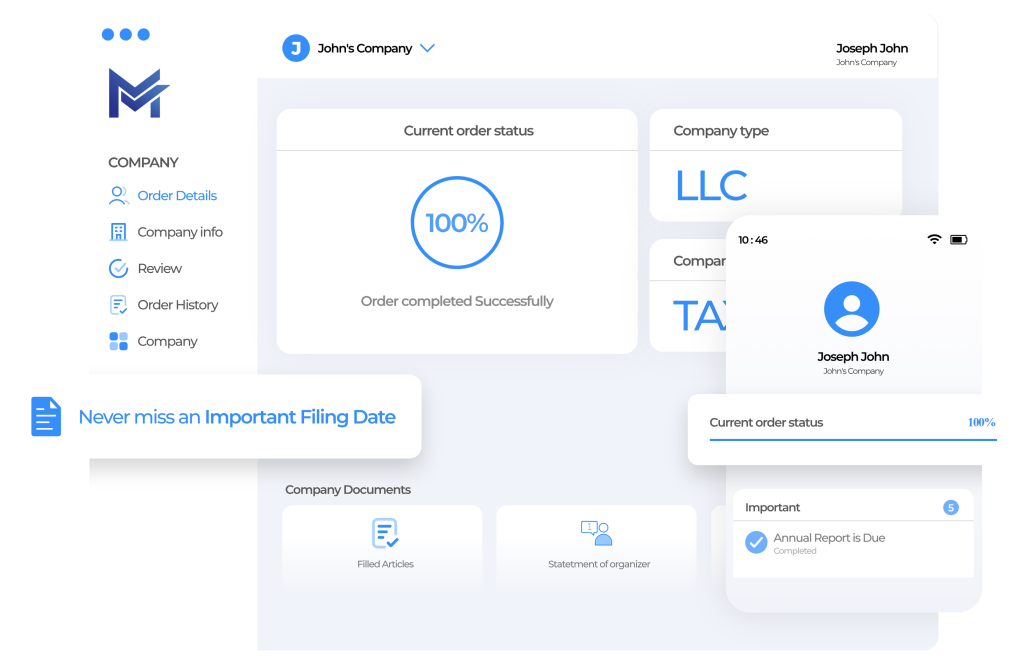

How Micahguruu Foundation Helps Amazon Sellers

At Micahguruu Foundation, we provide tailored LLC formation services for e-commerce entrepreneurs. Here’s how we support your Amazon business:

- LLC Formation: Quick and seamless registration for U.S. and international sellers.

- EIN Application: Obtain your Employer Identification Number for tax purposes.

- Compliance Support: Guidance on sales tax, annual reports, and state requirements.

- Business Consulting: Insights on scaling your Amazon store and improving profitability.

Frequently Asked Questions (FAQs)

1. Can I sell on Amazon without an LLC?

Yes, you can start as a sole proprietor, but an LLC offers significant benefits like liability protection, tax advantages, and enhanced credibility.

2. Do international sellers need an LLC to sell on Amazon U.S.?

It’s not mandatory, but having a U.S.-registered LLC simplifies the process of opening a seller account, managing taxes, and accessing U.S. banking services.

3. How much does it cost to form an LLC for my Amazon business?

The cost varies by state, but with Micahguruu Foundation, we offer affordable and transparent pricing. Contact us for a custom quote.

4. Can I switch to an LLC if I already have an Amazon store?

Yes, you can transfer your existing Amazon store to your LLC by updating your seller account details.

Ready to Launch Your E-Commerce Business?

The e-commerce industry, especially platforms like Amazon, offers incredible opportunities for entrepreneurs. With the right structure and support, you can turn your business idea into a thriving online store.

At Micahguruu Foundation, we’re here to make LLC formation easy, affordable, and hassle-free. Visit Our Services to learn more about our services and take the first step toward building your Amazon empire today!

Let’s turn your e-commerce dreams into reality—together!

Ready to Get Started?

Let us take the hassle out of LLC formation. Instantly, get started your LLC or contact us today to begin your e-commerce journey with confidence.

By choosing Micahguruu Foundation, you’re not just forming an LLC—you’re building